-

Traders ought to “beware” of a possible inventory market sell-off, in keeping with Fundstrat’s Tom Lee.

-

In a notice on Wednesday, he highlighted the rationale for promoting the shares within the coming weeks.

-

“We expect buyers simply should be vigilant,” he informed me.

A possible inventory market sell-off is imminent, in keeping with certainly one of Wall Avenue’s most dependable bulls.

Fundstrat’s Tom was my no one The most optimistic strategist on Wall Street when no one else was, His predictions made the buyers who adopted him massive cash. That is why Lee’s warning stands out in a notice on Wednesday.

Whereas Lee stays bullish on shares for the second half of the 12 months, he’s seeing troubling indicators which have prompted him to difficulty a tactical warning a couple of potential sell-off within the coming weeks.

“The markets are holding the sample till the July jobs report (report) and the July CPI. However watch out,” he mentioned. “Normally, we enter August a little bit extra cautiously than different months.”

Lee famous that the upcoming jobs report on Friday may very well be stronger than anticipated, and if that’s the case, this might lead buyers to wonder if the Federal Reserve has truly completed elevating rates of interest or not. The market is presently anticipating that the Federal Reserve has completed elevating charges, so any change in charge hike expectations can be a unfavourable shock for buyers.

Seasonal knowledge can be not serving to the market over the subsequent few weeks, which exhibits that August and September are weaker than most different months when it comes to inventory market returns.

Ryan Detrick, chief market strategist at The Carson Group, hit on this in a latest notice, arguing that “shares might lastly take some form of breather” resulting from seasonal weak spot in August and September. “We expect a modest 5% decline can be fully regular,” Detrick informed purchasers in Cairo. Note on Tuesday.

This, together with the truth that many Wall Avenue strategists are chasing this rally and elevating their year-end targets for the worth. Standard & Poor’s 500 After its sturdy year-to-date positive aspects, it suggests shares could also be resulting from decelerate.

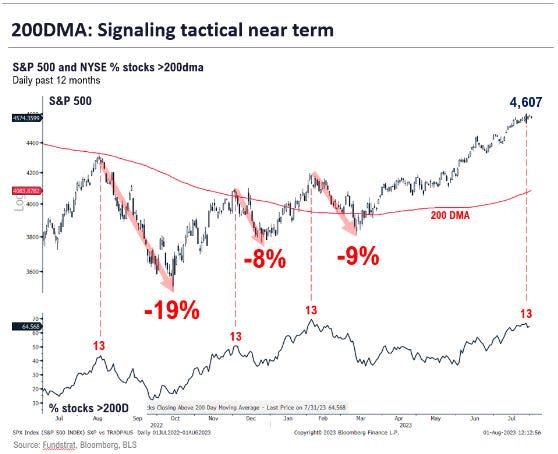

However maybe of extra concern is the technical promoting indicator that has simply appeared for the inventory market. Lee highlighted the DeMark Analytics “13” promote sign that was simply flashing.

The index measures the proportion of shares on the New York Inventory Alternate above the 200-day shifting common and is a measure of momentum within the inventory market.

The extra shares above the 200-day shifting common, the higher. However a flash of “13” throughout DeMark’s proprietary technical indicators signifies {that a} reversal within the inventory market could also be imminent.

The final thrice this sign has appeared over the previous 12 months, shares have suffered painful sell-offs: On Aug. 17, the S&P 500 fell 19%, on Dec. 1, the S&P 500 fell 8%, and on Feb. 2 the S&P rallied. 500 down 9%.

“A thirteenth place on this index may very well be an indication of a interval of higher turmoil. However for now, we expect buyers simply should be vigilant,” Lee mentioned.

Learn the unique article at Business interested